For broker-dealers and their clients, the ability to leverage a tiered payout structure to manage post-trade processes has become critical in maintaining a competitive advantage. Tiered payout structures provides a way for both brokers and broker-dealer firms, to improve the bottom line for the company as well increase their own compensation.

A tiered payout structure allows broker-dealers and their clients to enter into complex trading agreements that are not possible through clearing houses’ payout structure. While a clearing house can only code one structure for broker-dealer payouts into its system, broker-dealers may want to set up their payout structure with their clients using a volume-based approach.

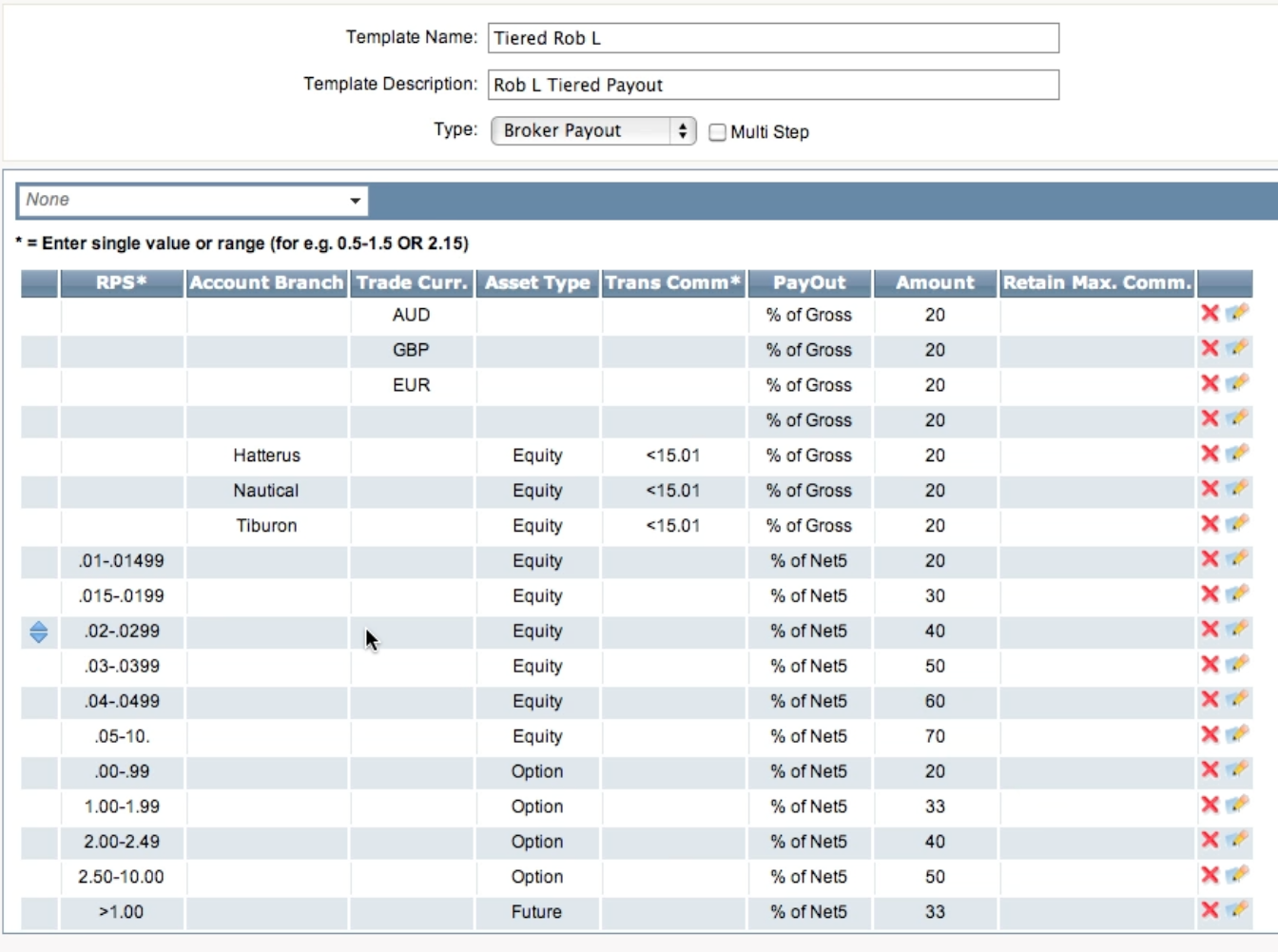

Using a tiered payout structure, broker-dealers can charge less when their clients trade more. For example, a broker-dealer may tell their client that each of the first million trades they do every month costs one cent. For each trade between one million and three million, the broker-dealer will charge $.08. Each trade between three million and six million will cost $.06. This type of structure can also be set up for the broker-dealer-dealer, where the broker-dealer receives more the more his or her clients trade. Another example of a tiered payout structure is shown below:

In both of these cases, a tiered payout structure is an incentive to do more business. This makes clients happy because they are able to do more volume at a lower cost. Broker-dealers will also be pleased since they will likely make more money regardless of where the incentive is directed.

Being able to offer broker-dealers or their clients a tiered payout structure can help give you an edge on the competition. However, tiered payouts are incredibly difficult to keep track of using the typical Excel spreadsheet method, which can end up being more time and effort than it is worth and leave you vulnerable to errors.

By leveraging our broker-dealer back office system, you can manage complex payout structures from a central location. With our BOSS platform, your payout and commission structure can be setup and then run automatically every time a new trade comes in.

For each broker-dealer in the Back Office Support Solution (BOSS) platform, a tiered payout structure can be set up for each client using our flexible “Rules Engine”. All of the trades the broker-dealer’s clients engage in are then tracked, and the system calculates the volume to determine what payout is appropriate.

Being able to manage payouts and commissions in this way will allow broker-dealers and their clients to setup more complex trade agreements without the worry of how to keep track of it all. The BOSS platform allows you to easily track all trades and payouts from a centralized system—eliminating the hours of labor spent managing Excel spreadsheets.

If you would like to know more about our broker-dealer back office system for Tiered Payouts, click here. If you have any questions, please feel free to contact us.